iowa property tax calculator

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The Iowa property tax is primarily a tax on real property which is mostly land buildings structures and other improvements that are constructed on or in the land attached to the land.

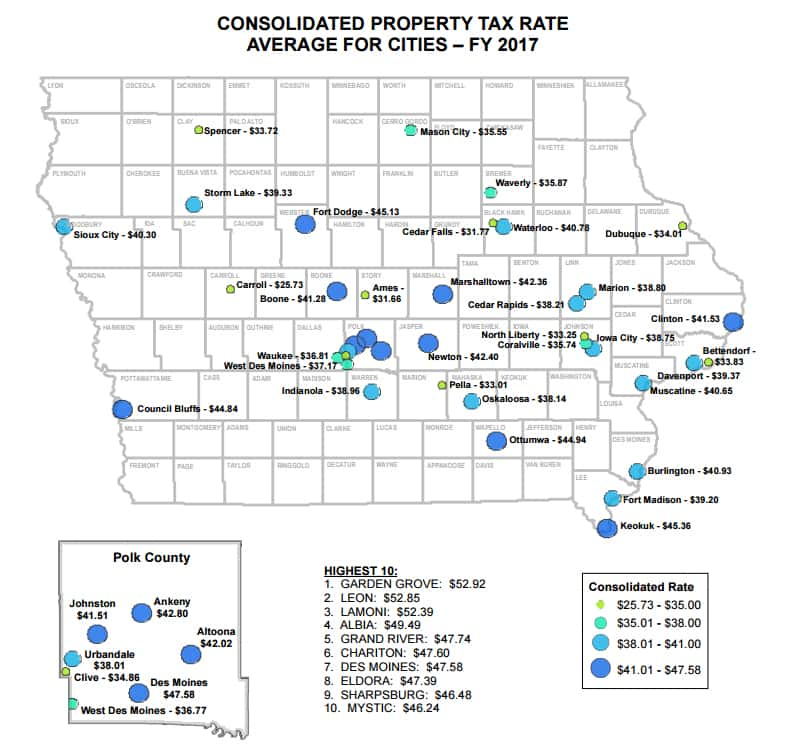

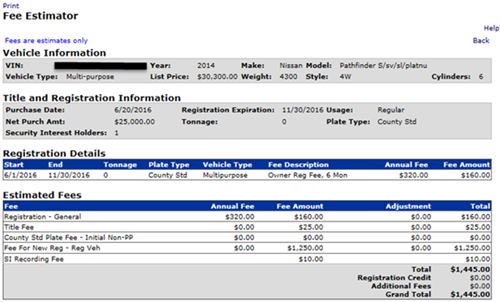

Calculate Your Transfer Fee Credit Iowa Tax And Tags

The Amount Payable Online represents all taxes that are payable online for each.

. Credits and exemptions are applied only to annual gross net taxes total. Iowa County Iowa - Real Estate Transfer Tax Calculator. 1932-1939 50 per 500.

Other credits or exemptions may apply. Get Involved - Volunteer. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Iowa Real Estate Transfer Tax Calculator Enter the total amount paid. For comparison the median home value in Clinton County is. - Dallas County Iowa Courthouse 801 Court Street Rm.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The property tax estimator assumes that property taxes are paid on September 1st and March 1st. Annual property tax amount.

This calculation is based on 160 per thousand and the first 50000 is exempt. Total Amount Paid Rounded Up to. You may calculate real estate transfer tax by entering the total amount paid for the.

Iowa Capital Gains Tax. This Property Tax Calculator is for informational use only and may not properly. So if you pay 2000 in Iowa state taxes and your school district.

NOTICE Effective August 16 October 31 2022. 2 Tax levy is per thousand dollars of value. 1940-1967 55 per 500 1st 100 exempt 1968.

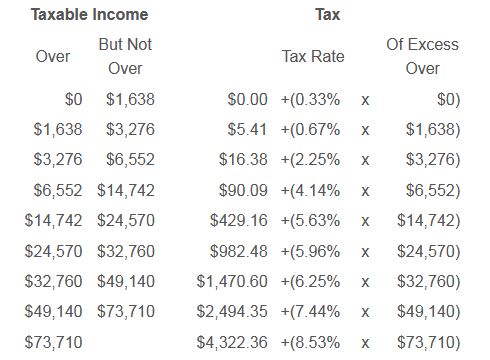

Both long- and short-term capital gains are taxed at the full Iowa income tax rates depending on your income tax bracket. Iowa Tax Proration Calculator Todays date. That means that when paying.

1 2018 State of Iowa Rollback - Residential Class - gross taxable value is rounded to the nearest 10. Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period. The calculation is based on 160 per thousand with the first 500 being exempt.

Iowa property taxes are paid in arrears. Iowas median income is 58613 per year so the median yearly property tax paid by Iowa residents amounts to approximately of their yearly income. In 2021 the Iowa legislature passed SF 619.

Division 28 of that bill expanded eligibility for the property tax credit under Iowa Code chapter 425 subchapter II based on. Property taxes may be paid in semi-annual installments due September and March. Many of Iowas 327 school districts levy an income surtax that is equal to a percentage of the Iowa taxes paid by residents.

Iowa Tax Proration Calculator. Annual property tax amount. For comparison the median home value in Dubuque County is.

For comparison the median home value in Iowa is 12200000. If you would like to update your Iowa withholding. Fields notated with are required.

Iowa is ranked 26th of the 50.

Iowa Property Taxes By County 2022

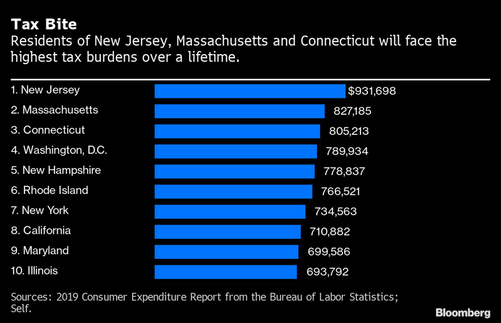

New Jersey Taxes Newjerseyalmanac Com

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Property Tax Scott County Iowa

City Of Mason City Government Per Iowa Code 384 15a The Notice Of Public Hearing Proposed Property Tax Levy Sheet Is Attached And Can Also Be Viewed At Https Www Masoncity Net Facebook

Pella Tax Rates Low Among Large Cities In Latest Property Tax Data Knia Krls Radio The One To Count On

How High Are Property Taxes In Your State Tax Foundation

State Tax Levels In The United States Wikipedia

Does An Iowa School Property Tax Rate School Property Taxes No Mary Murphy

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Hendrickson Time To Solve Iowa S Property Tax Problem The Iowa Torch

Iowa Legislature Sends Significant Tax Bill To The Governor Center For Agricultural Law And Taxation

Iowa City Property Tax Rate Drops In Proposed Budget Water Rates Going Up As Procter Gamble Downs The Gazette

Coralville To Hold Public Hearing On February 8 For Proposed Property Tax Levy Iowa City Today

Those Crazy Iowa Property Taxes Home Sweet Des Moines

Iowa Department Of Revenue Issues Key Guidance On Dpad Like Kind Exchange And 2019 Income Tax Brackets Center For Agricultural Law And Taxation